The financial services industry has traditionally been male-dominated—it’s a historical fact. Unfortunately, this has carried over into fintech as well. Here’s a curious thing: actual market data favors gender diversity. McKinsey & Company, for example, reported that companies with more women in leadership roles are 25 percent more likely to be profitable. The evidence looks encouraging, yet women in fintech keep running into barriers in hiring practices and career growth. A survey from 2024 showed that over 40 percent of women have felt discriminated against during job interviews because of their gender.

The only positive thing about this situation is that change will happen very soon; there’s a lot of talk in the industry about gender issues, and regulatory efforts are even being made to eliminate them. But the bad news is that it’s not enough. If we want to close the gap, we have to take action. We must change our mindsets profoundly and initiate tangible actions to neutralize the issue.

Examples of gender gap barriers

The gender gap in finance and fintech is not just about their presence among leadership. Historically, women have always been at a disadvantage when accessing financial services. In the U.S., before the 1970s, women needed approval from their husbands or fathers to apply for a credit card. They couldn’t make that choice for themselves. Fortunately, things are somewhat better now, and such practices no longer exist. But that doesn’t mean inequalities have disappeared completely. Women in many countries still struggle to access financial tools on the same level as men. In India, access to formal banking and credit use among women is vastly lacking. Despite the presence of female entrepreneurs there, over 90 percent of women don’t borrow from official financial institutions. This limits their ability to start a business, invest or even build fundamental financial independence.

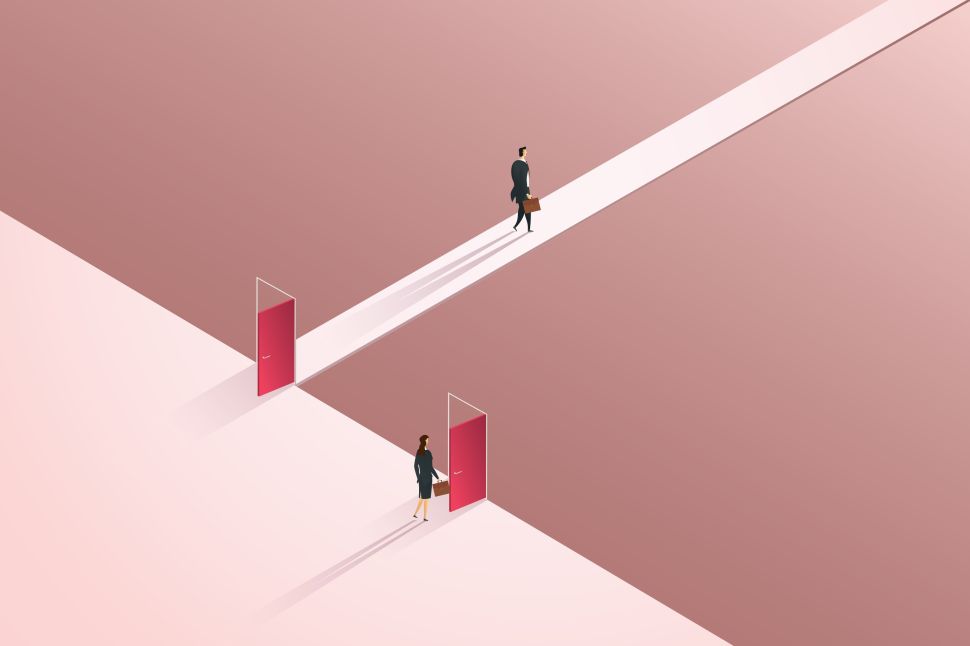

Fintech recruitment and promotion practices have been noted to lack transparency, making it difficult for women to move up the career ladder. A study from 2023 showed that in the UK, the gender split among board directors heavily favors men (61 percent male versus 39 percent female).

Social perception and stereotypes have also played a significant role in this imbalance. There is a lingering view of finance as a “male” field, so women have often felt discouraged from pursuing careers in this field. And it’s not just about hiring; it’s also about a lack of mentorship and networking opportunities and having role models that could have otherwise inspired them to do it. So, what can be done about it?

Shifting climate and regulatory efforts

As mentioned, the industry is becoming more aware of these issues, and regulators worldwide are gradually increasing their efforts to enforce change. In 2022, the EU passed a gender balance directive that requires public companies to improve the male-female representation on their boards. By 2026, at least 40 percent of board seats should be held by women. Another similar example is Germany’s Leadership Positions Act: according to it, since 2021, public companies in Germany have been required to fill at least 30 percent of board seats with women.

Hiring transparency has also seen some improvements. In 2017, the UK introduced Gender Pay Gap Reporting, demanding that companies with more than 250 employees disclose differences between male and female compensation. It’s an interesting idea, but it could be better. Many fintech firms are small-scale startups that don’t go beyond mid-size even when adequately established. That means they would slip under the radar of such a rule, making it ineffective. In Australia, meanwhile, the Women in Banking and Finance Charter, established in 2021, introduced accountability practices. Under it, companies must set gender diversity goals and report progress to the local regulators.

However, while some regions are progressing, others are moving in the opposite direction. In the U.S., policies designed to promote diversity, equity and inclusion (DEI) have been seeing increasing pushback. Many companies have begun scaling back or even eliminating these initiatives.

On the one hand, this is concerning. DEI efforts don’t just benefit racial minorities—they also support women. Without structured policies to encourage diverse hiring, women may continue to face barriers to career advancement for a long time.

On the other hand, President Donald Trump has rolled back DEI initiatives at the government level, emphasizing that the push to reduce DEI policies aims to prioritize actual merit and qualifications instead of factors like race or gender. This stance does make a certain amount of sense. To any business, the ability to get results matters first and foremost. So, it is not unreasonable to expect an employee’s qualifications to be more important than their gender.

What can we do?

All of the measures discussed above have certainly played their part and achieved a positive impact on promoting gender equality, but it’s still not enough. Satisfying necessary quotas mandated by one law or another is not the same as addressing deeper cultural issues. Without straying too far from the subject of rules and regulations, it bears reiterating that the same kind of oversight could and should be applied to smaller firms, not just the ones with 250 employees. Otherwise, many transparency issues will remain unaddressed.

More importantly, any corporate initiative to hire more women should be rooted in a fundamental purpose with specific benefits in mind—not just to satisfy the word of law. Diversity shouldn’t be just about equal numbers but about providing equal opportunities to all candidates because they have the skills to match. That’s how you build a genuinely fair and inclusive environment.

Finally, the fintech market as a whole should place greater emphasis on mentorship and leadership programs for women. The lack of female leadership is partially due to a lack of support when they first start out. My company has contributed to supporting such initiatives, so I can speak first-hand of how encouraging women can find it when they have a place to express their concerns and be heard. Seeing examples of fellow women in prominent positions can inspire them to advance in this sector and find success.

Valentina Drofa is a financial market consultant and Co-Founder and CEO of Drofa Comms, an international PR consultancy specializing in financial and fintech sectors. Valentina has a PhD in Economics and is the author of several books on financial literacy.