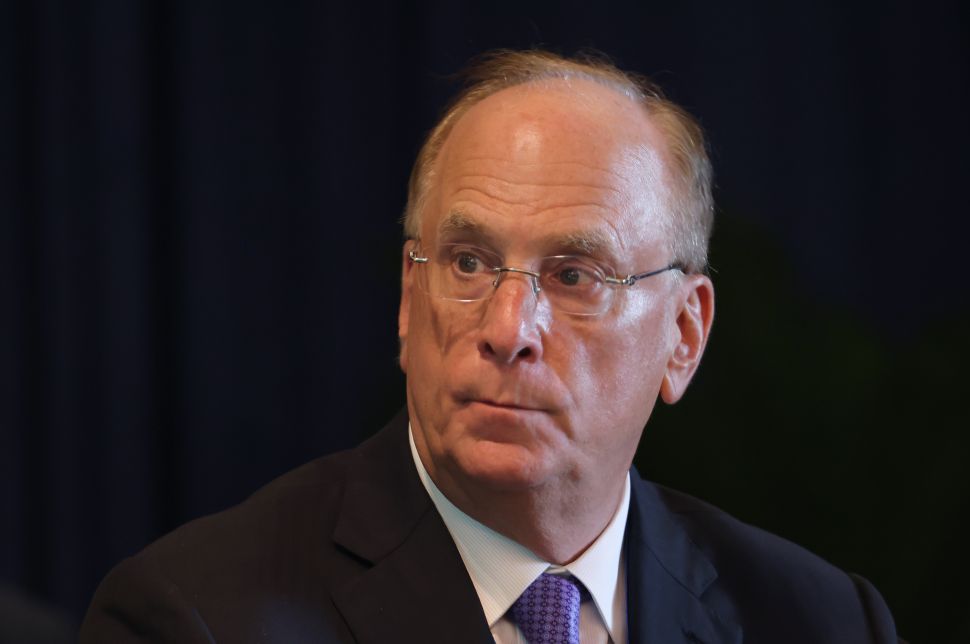

The ongoing Los Angeles wildfires have destroyed or damaged some 12,000 structures, incinerated entire neighborhoods and wiped out businesses and landmarks alike. The extensive damage, which took place in less than ten days, could take up to ten years to repair, according to Larry Fink, CEO and chairman of BlackRock, which manages enormous assets for insurance companies affected by the natural disaster.

“When you have whole neighborhoods destroyed and you have infrastructure and schools and supermarkets destroyed, this is not a one-year fix,” said Fink yesterday (Jan. 15) in an interview with CNBC. “This is going to be five, six, seven, maybe ten years of fixing.”

Overseeing some $11.6 trillion, BlackRock is the world’s largest asset manager and houses around $700 billion managed for insurance companies. During the company’s third-quarter earnings call yesterday, Fink pointed to insurance as “one of the primary areas of growth for us.”

The sheer amount of damage wrought by the Los Angeles fires will make homeowners insurance an increasingly pertinent topic in the U.S. going forward, Fink said. The devastating event is also a personal one for the BlackRock executive, who is a Los Angeles native.

Hiking the Santa Monica Mountains, where one of the ongoing wildfires broke out, was “one of my pleasures of growing up, looking for snakes and reptiles as a kid, walking through the chaparral,” he said, recalling living in Los Angeles during the great Bel Air Fire of 1961. “We’ve always had fires in Los Angeles, but we’ve never seen destruction like this.”

What do the 2025 LA fires mean for homeowners insurance?

The ongoing wildfires have killed at least 25 people and brought unprecedented economic damage. Losses for the insurance industry could climb as high as $40 billion, according to analysts from Keefe Bruyette & Woods, while Wells Fargo and Goldman Sachs have estimated $30 billion in costs to insurers. These numbers surpass the $12.5 million in losses from California’s 2018 Camp Fire—the largest insured wildfire loss to date.

The sheer amount of destroyed homes—many of which were in well-to-do neighborhoods like the Pacific Palisades or Altadena, which Zillow estimates have average home values of $3.5 million and $1.2 million respectively—will shine a spotlight on the role of homeowners insurance across America, according to Fink.

In recent years and months, numerous insurance companies have withdrawn coverage from wildfire-prone areas in California. Los Angeles County, for example, has reportedly seen 531,000 homeowner policies canceled between 2020 and 2022. The pullback has forced many California residents to turn to the California FAIR plan, the state’s last-resort insurance program. The FAIR plan’s total exposure as of September was $448 billion—a 61 percent increase year-over-year and a 123 percent jump compared to 2020.

Besides potentially spurring a redefinition of event risk throughout the U.S., the aftermath of the Los Angeles fires means homeowners insurance will become a key topic for governments going forward, Fink told CNBC. “This is going to be one of the bigger issues that we’re going to have to be tackling over the next four years.”