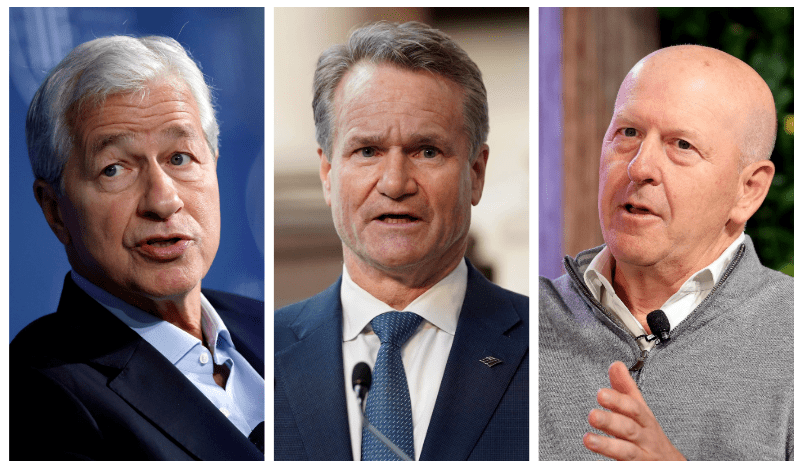

Expectations for a pro-business playbook under the incoming Trump administration hasn’t just buoyed the earnings of major banks like JPMorgan, Bank of America (BAC) and Goldman Sachs (GS)—it’s also lifted the spirits of their CEOs. While reporting earnings earlier this week, Wall Street leaders demonstrated a noticeably sunny attitude towards the banking industry’s future.

Banks are undoubtedly one of the biggest winners of the recent presidential election, given widespread views that Trump will prioritize a pro-growth and deregulatory environment that is likely to result in a boost in capital raising and a jump in mergers and acquisitions. “There has been a meaningful shift in CEO confidence, particularly following the results of the U.S. election,” said David Solomon, CEO of Goldman Sachs, during his company’s fourth quarter earnings call. Wells Fargo (WFC)’s Charles Scharf, meanwhile, told analysts that his optimism about 2025 is linked to “the business-friendly approach from the incoming administration.”

The flood of cautious hopefulness comes on the heels of a strong earnings seasons for big banks. Goldman Sachs’ profit between October and December of 2024 nearly doubled year-over-year, while JPMorgan and Wells Fargo reported respective jumps of 5o percent and 47 percent. Net income increased by 116 percent at Bank of America during the holiday quarter and reached $2.9 billion at Citigroup (C), compared to its net loss of $1.8 billion a year prior.

Here’s a look at what Wall Street executives are saying about their hopes for the incoming administration:

David Solomon, CEO of Goldman Sachs

Since Trump’s election win, Solomon has picked up on a change in attitude amongst his peers. “There’s been a sentiment shift broadly as I talk to CEOs since the election,” the banking executive told analysts earlier this week, adding that he’s preparing for “an overall increased appetite for dealmaking supported by an improving regulatory backdrop.”

Jamie Dimon, CEO of JPMorgan Chase

Dimon also highlighted positivity across the banking industry. Businesses “are encouraged by expectations for a more pro-growth agenda and improved collaboration between government and business,” said Dimon in a statement accompanying JPMorgan’s fourth-quarter earnings report.

Dimon is still proceeding with caution—he pointed towards an inflationary environment and dangerous geopolitical conditions as “two significant risks” to keep an eye on going forward.

Charles Scharf, CEO of Wells Fargo

“We succeed when the country succeeds, so the incoming administration’s support of U.S. businesses and consumers gives us optimism as we look forward,” Scharf said on an earnings call earlier this week. He added that the incoming administration has “signaled a more business-friendly approach to policies and regulation, which should benefit the economy and our clients.”

Brian Moynihan, CEO of Bank of America

Moynihan said he’s looking forward “to driving the company forward in 2025 against the backdrop of a solid economic environment” in a statement. His chief financial officer Alastair Borthwick told analysts that the bank’s momentum can be attributed to “expectations for more deals to be completed” amid a pro-business climate.

Jane Fraser, CEO of Citigroup

Fraser is hopeful that economic stability and receding inflation will carry over into this year. “While policies will certainly impact economic activity, whether in the form of tariffs or taxes, 2025 doesn’t look that different from 2024,” Fraser told analysts. “As we head into a great environment in 2025 that should be pretty conducive for a lot of client activity, I’m very confident that we’re well positioned,” she added.