Photo: Chip Somodevilla/Getty Images

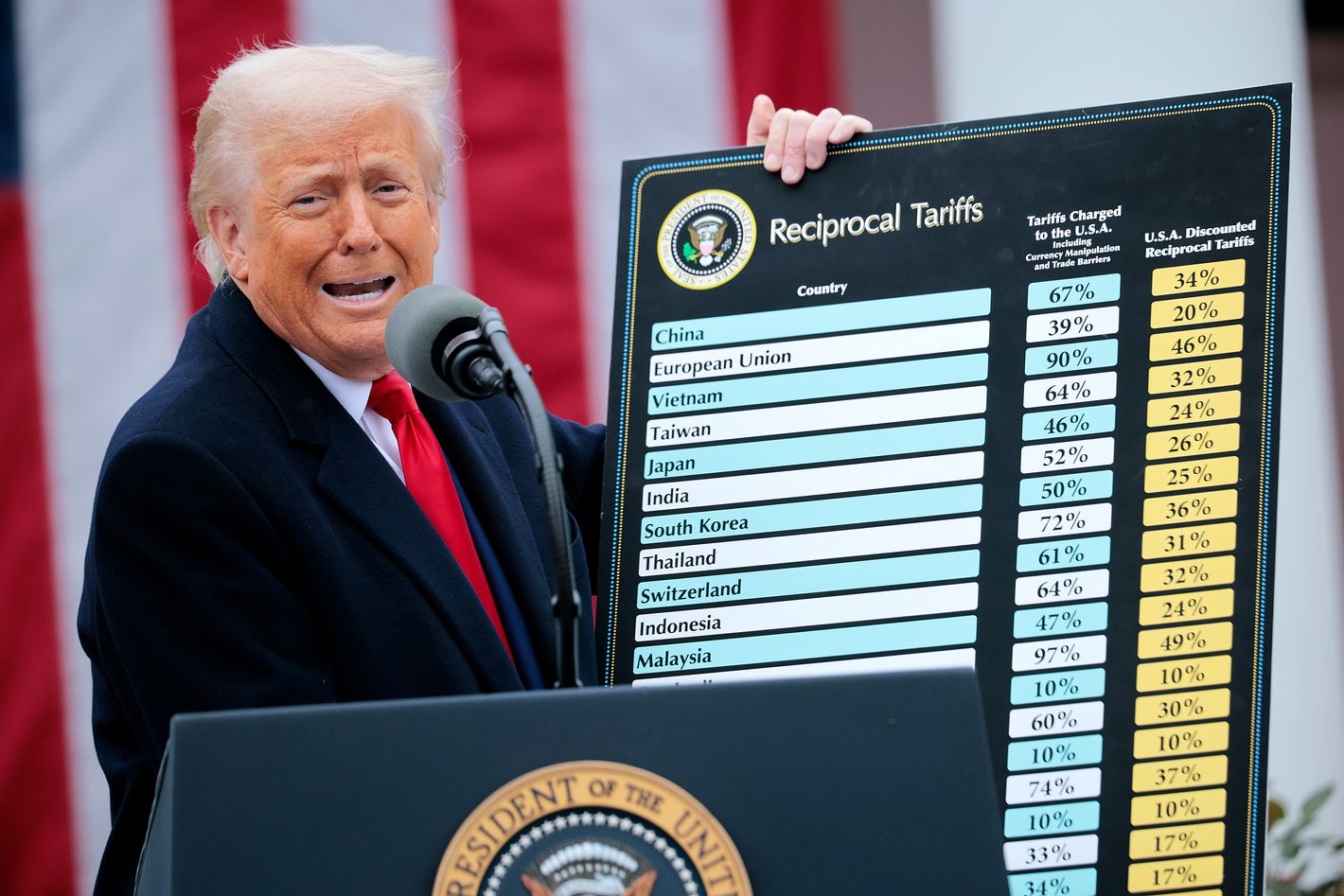

This morning, American markets fell and rose by trillions of dollars over a misinterpreted cable news interview, a few headlines, and a flurry of misleading posts on X. As the chaos continued, harried financial professionals and journalists tried to piece together the particulars. Was it a Reuters misreading of a CNBC chyron that started it, or did finance aggregator account “Walter B1oomberg,” which despite its name and massive following, has nothing to do with Bloomberg L.P., drive the action? How much trading did a sourceless post from the conspiratorial financial blogger ZeroHedge drive? Why, in the middle of all this, is the White House doing damage control by responding to an account called “unusual_whales?” In any case, somewhere near the center of the conversation is this clip:

KILMEADE: Would Trump consider a 90 days pause in tariffs?

HASSETT: I think the president is gonna decide what the president is gonna decide … even if you think there will be some negative effect from the trade side, that’s still a small share of GDP pic.twitter.com/3KymvgOwQG

— Aaron Rupar (@atrupar) April 7, 2025

We don’t actually learn anything specific about tariffs in this interview, which is, in context, a White House economic advisor responding to a leading question from a Fox News host about a tweet from hedge fund manager Bill Ackman. We do, however, find some support for a theory that’s getting stronger by the day: Donald Trump is turning the market into a giant meme stock that trades on what people imagine is going on inside the president’s head.

i think this is ironically why markets aren’t down more, especially after the walter bloomberg pump, everyone in the market and in the white house knows that trump could trace back a major portion of the fall with a single tweet https://t.co/1JWD5P1tHw

— Matthew Zeitlin (@MattZeitlin) April 7, 2025

Most people probably associate meme stocks with wild market swings among companies that don’t have a strong conventional case for investment — not with anything resembling massive index collapses. Companies like GameStop, AMC, and Bed Bath & Beyond saw their stocks shoot up as groups of online retail investors talked each other into buying them. They told wildly optimistic stories about how these companies might turn things around, the substance of which was less important than their existence as fun theories to rally around. If enough people believed them (or acted as though they believed them) the stock went up. If they didn’t, it went back down. Meme stocks weren’t categorically different from a lot of other trading — lots of flimsy and ridiculous theses and social phenomena drive investment in companies with strong “fundamentals,” too — but they were more extreme. It didn’t take long for meme stock CEOs to try to get in on the bit, whipping their stock prices around with fantastical plans and projections, helping to keep their prices from attaching too firmly to anything presently measurable or, for lack of a better word, real. Some meme stocks fell back to Earth, others muddled along, and a few seemed to approach escape velocity, or at least achieve some sort of stable orbit, on the power of pure narrative.

Now, in April of 2025, if you step back — way back — you can tell a similar story about the Dow Jones in the months since the election. After Trump won, markets surged. This time, it wasn’t retail traders on Reddit, Discords, and Twitter constructing lucrative new realities, but rather mainstream business leaders, financiers, and politicians talking each other into bullish predictions in public interviews, speeches, and research notes (to be fair, this also involved a lot of tweeting, too).

Their wildly optimistic story was particularly intoxicating not for its Mars-bound extravagance but for its familiarity. The story ran something like this: The second Trump administration would, in terms most relevant to investors, be a lot like the first. Iit would be above-all business-friendly; there would be less government spending, maybe, but also less regulation for energy, tech, crypto, real estate, healthcare, you name it. When it came to the economy, in other words, Trump would govern like a Republican, with maybe a bit more unpredictability than usual, and some trade war theatrics, but nothing too crazy — he’d mostly use tariffs as threats, right? There would be smart people around to limit damage, anyway. Sure, there would be some obvious grifting and corruption, but that, too, would be an opportunity to buy in — a case for buying some Tesla and Palantir, each already meme stocks in their own right, and maybe a little Trump Media & Technology Group, the micro-scale predecessor to the market-wide “Trump Trade.” Plus, hey, nobody would be “woke” anymore:

incredible bit, honestly https://t.co/ogOkm8rb77 pic.twitter.com/MJJlyhu2fl

— alexandra scaggs (@alexandrascaggs) January 14, 2025

All of this could have come true, and much of it might still, but the last few weeks have seen this thesis — mainstream finance’s equivalent of a gleefully delusional “due diligence” report on /r/WallStreetBets — lose its credibility in favor of one built on the actual fundamentals of the situation: A president for whom the greatness of tariffs are one few clear and consistent beliefs over many decades, who thinks trade deficits are theft, and who ran on solving the latter problem with the former strategy, has stocked his entire administration with loyalists and is doing what he said he wanted to do, by fiat whenever possible. His government’s “efficiency” initiative is a nakedly ideological slash-and-burn project run by the first guy to fully merge large-scale industrialism with meme stock logic. The tech industry wasn’t saved from antitrust enforcement, but rather saw it weaponized by a president whose relationship to big tech is all about favors, threats, and protection. TikTok, the continued existence of which could have major consequences for American tech giants, has been turned into a geopolitical bargaining chip. Perhaps more significantly, the president has basically declared the authority to ignore the law as it exists in order to keep it online, a tactic and precedent with potentially wild implications for doing business in the U.S.

I have no anger toward Dems. Just disappointment.

I don’t think this was foreseeable. I assumed economic rationality would be paramount. My bad.

— Bill Ackman (@BillAckman) April 7, 2025

The cycle’s crypto donors got some of what they wanted, but also a fresh legitimacy crisis in the form of Trump-branded meme coins, not to mention last week’s crash. Universities and law firms are being threatened into submission, and corporate leaders are wondering if they’re next. In the maximally detached language of finance, suddenly there’s an awful lot of uncertainty.

That markets would plunge with the announcement of massive and near-universal tariffs makes sense. That they would shoot back up on thin evidence that the tariffs might be temporary, or that they should be understood as a source of temporary leverage rather than a plan, makes sense as well. But that’s clearly not all that’s happening here. Hassett’s comments weren’t just seen as a clue about the strategy of an administration’s economic team; they were understood primarily as shreds of evidence about the president’s individual priorities and state of mind.

Trump is seeking to become to the American economy what his appointee Elon Musk is to his constellation of companies: A singular figure whose unreliable word, personal instincts, preferences, misapprehensions, and neuroses drive are a primary factor for investors. In November, investors made up one story about the president. By February, he was telling them quite a different one. Now, in April, his staunchest supporters are suddenly speaking the language of finance, improvising a market-wide meme stock thesis about a “great reset,” urging everyone to trust the plan, and posting in lockstep about green trading days to come. Like Musk, who recently assured ailing Tesla investors, vaguely, that “It will be fine long-term,” Trump is workshopping new pitches. As a candidate, he promised a “boom like no other.” For now, he has a series of commands: “Don’t be weak! Don’t be stupid! Don’t be a PANICAN! (A new party based on Weak and Stupid people!)”