Nvidia (NVDA) has had a bumpy start of 2025. Share price of the A.I. chip giant surged to record highs at the beginning of the year and then fell sharply in late January after the Chinese startup DeepSeek shook Silicon Valley. Now, analysts are eagerly anticipating Nvidia’s fourth-quarter and 2024 financial results, set to release tomorrow (Feb. 26), to gauge its actual position in the A.I. race. Nvidia is the world’s second most valuable public company with a market cap of more than $3.1 trillion, meaning its earnings report could also have major implications for the broader stock market.

Wall Street expects Nvidia’s quarterly revenue to soar 72 percent to $38 billion and profit to jump 64 percent to $19.6 billion. But to keep its share price on an upward trajectory, the company might have to do even better. To avoid a sell-off, Nvidia must meet its “normal exceed,” Ted Mortonson, managing director at Baird, told Fortune.

While DeepSeek’s cost-efficient breakthrough initially led investors to believe demand for A.I. chips could fall, some analysts have pushed back on such fears. “We believe that A.I. GPU demand still exceeds supply, so while slimmer models may enable greater development for the same number of chips, we still think tech firms will continue to buy all the GPUs they can as part of this A.I. ‘gold rush,’” said Brian Colello, a Morningstar analyst, in a January note.

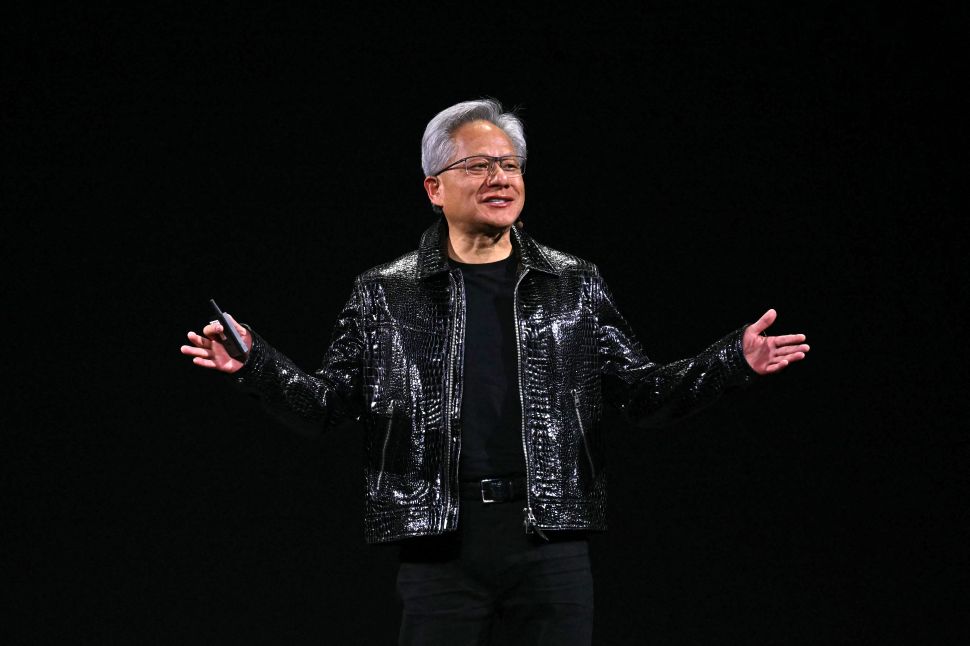

Nvidia CEO Jensen Huang praised DeepSeek in a recent interview for “making everybody take notice” of opportunities for more efficient A.I. models. While the initial market response suggested Wall Street was losing faith in compute investments, Huang claimed “it’s exactly the opposite,” given the “fairly compute-intensive” nature of reasoning-focused models like DeepSeek’s R1.

But Nvidia stock took another hit on Feb. 21, falling 4 percent after the investment bank TD Cowen reported that Microsoft has cancelled leases for at least two data center operators. The news sparked concerns over a decline in demand for A.I. compute. “It points to a potential oversupply position,” said TD Cowen analysts in the report. In response, Microsoft noted that it is “well positioned” to meet increasing demand but may “strategically pace or adjust” its infrastructure in some areas.

Is Nvidia back on track?

Nvidia’s earnings come amid a broader market downturn. Last week, major indexes saw their worst day this year so far in response to weaker-than-expected economic reports on the U.S. services sector and consumer sentiment. But when it comes to A.I., tech bulls are confident that Nvidia’s quarterly earnings will put an end to Wall Street’s caution. While the market is “heavily skewed negative right now around tech sentiment,” Nvidia’s upcoming performance should “calm the nerves of investors,” said Dan Ives of Wedbush Securities in a client note. Updates on Nvidia’s new Blackwell chip and demand from Big Tech clients will continue to fuel optimism towards the technology, Ives added.

Companies like Microsoft, Meta, Alphabet and Amazon are expected to spend more than $300 billion cumulatively this year on A.I. efforts, including buying Nvidia chips. “After speaking with many enterprise A.I. customers, we have not seen one A.I. enterprise slow down or change,” said Ives, who added that no clients want to “lose their place in line” for Nvidia’s next-gen chips.

During Nvidia’s last earnings call in November, Huang noted that Blackwell production was “in full steam.” The success of Nvidia’s transition to its next-gen GPUs will be closely watched when the company reports earnings tomorrow.

“All eyes will be on Blackwell commentary,” according to Hans Mosemann, an analyst with Rosenblatt who predicts that Huang will reaffirm that demand for shipments remains high throughout 2025. “We see shipments of Blackwell accelerating as we progress through the year, with a stronger [second half].”