Energy markets in 2025 aren’t reacting to policy—they’re reacting to unpredictability. From tariffs to tanker traffic, volatility is the only certainty. This shift means that the official forecasts global oil experts once relied on, which assumed energy prices would remain low this year, might be inaccurate, especially if a seaborne conflict consuming significant amounts of fossil fuel suddenly erupts.

Investors Still Favor Alternative Energy Over Classics

Energy investments keep shifting towards alternative (renewable) energy sources, since major global economies remain steadfast in their commitment to achieving carbon neutrality. Given the mounting oversupply, we anticipate a gradual decline in new oil sector projects. While the costs associated with geological exploration and exploratory drilling have generally decreased, the financial burden of maintaining the competitiveness of the oil industry, along with stricter environmental regulations, is on the rise. Even shale—the former savior of U.S. energy independence—can’t compete on cost anymore. Capital is no longer hedging its bets—renewables are where the returns are. Oil’s sunk costs and regulatory baggage are bleeding out investor patience.

An additional risk for oil is the upcoming deal between the U.S. and Iran, where negotiations are ongoing. If a temporary “nuclear deal” is negotiated, the market is expected to receive around two million barrels per day of surplus oil. In this case, there is potential for Brent to further decline toward the $50 level, the basis for OPEC+ and the U.S. to reduce oil production.

Europe’s Energy Security Concerns and Their Tally

European countries have continued their efforts to diversify energy sources away from Russia. The structure of energy imports to the EU has changed significantly in recent years. Although, despite sanctions, Russian oil and gas continue to flow to Europe through alternative channels — including via the so-called “shadow” fleet — fundamental changes are already envisaged. In 2024, the US became the EU’s largest import partner for liquefied natural gas and distillates. Norway strengthened its position as the EU’s largest import partner for pipeline natural gas in 2024. Thus, EU imports of natural gas (both LNG and pipeline) from Russia, which amounted to 150 bcm in 2021, were almost halved (to 80 bcm) in 2022 and reduced by the same amount (to 43 bcm) in 2023.

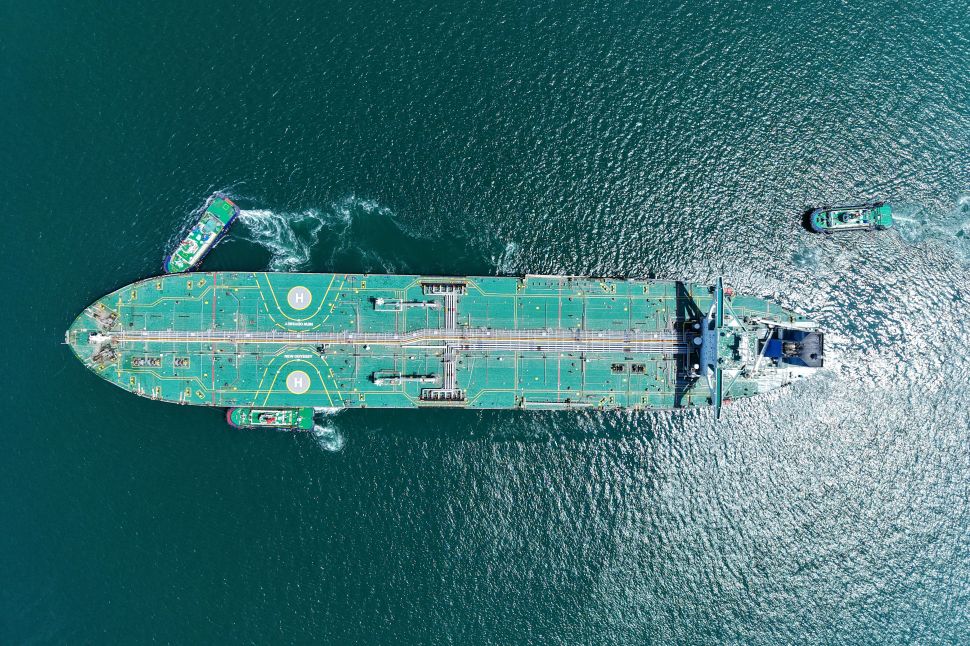

As for crude oil imports, there are no confirmed statistics due to the lack of methods to identify the origin of tankers, although the volume of oil pumped through oil pipelines has dropped dramatically, and by the end of 2024, only the Southern (Turkish) Stream remained from the operating branches. By late 2023, Europe had slashed Russian fossil fuel imports by over 80 percent. But with that independence came inflation—paid out, month after month, by retail consumers. .

It is becoming increasingly evident that the burden of these changes falls on European retail energy consumers, who are experiencing rising inflationary pressures. EU energy bills jumped 12 percent on average after the price cap lift, with spikes of 16 percent in January 2023 alone. Inflation has become the hidden cost of energy independence.

OPEC+ Overproduction Challenges and Responses

OPEC+ is currently facing an increasingly complex situation. On one hand, the oil cartel must assert its dominance in the global oil market and prevent a steep and prolonged decline in oil prices. At the same time, it must solidify ties with major consumer nations like the U.S., Europe, and China, each with its strategic interests.

The decision by OPEC+ to ramp up oil production starting in April 2025 is largely motivated by its need to maintain market share amid trade tensions. The member countries are less worried about falling oil prices and more concerned about losing ground to the U.S., which is no longer just a temporary issue from the previous administration but a long-term reality. Moreover, OPEC+ anticipates only a slight decrease in supply, primarily due to sanctions imposed by the Trump administration on Iranian and Venezuelan oil, as the alliance members push forward with their production plans.

The oil cartel has committed to increasing output by 411,000 barrels per day next month, equivalent to three monthly boosts from their earlier production recovery. Consequently, crude oil prices dipped below $69 for the first time since March 11. This drop coincides with the Trump administration’s sanctions against Venezuela earlier last month, which have compelled major oil companies like Global Oil to halt operations there, potentially disrupting oil supply chains. With Global Oil’s exit and Chevron (CVX)’s earlier withdrawal, Venezuela is left with fewer international partners, raising concerns about the future viability of its oil industry.

Russia’s Role in Balancing the Global Oil and Gas Demand

Russia’s oil revenues have dropped to their lowest point since mid-2023. In the four weeks through April 13, Russia’s offshore oil shipments reportedly fell to 3.13 million bpd, the lowest since February and about 320,000 bpd below the previous low. Using a monetary measure, the gross value of oil shipments decreased by approximately $80 million, or 6 percent, to $1.29 billion per week, marking the lowest level since July 16, 2023.

In addition, OPEC+ demanded that seven countries that previously breached their commitments—Iraq, Kuwait, Saudi Arabia, the UAE, Oman, Kazakhstan and Russia—compensate for 4.57 million barrels per day of underproduction by June 2026. According to the organization, Russian overproduction amounted to 691,000 b/s. The timeframe for compliance is quite comfortable, but the Russian oil market and expectations of revenues from oil sales to the budget are largely driven by the presence of these resources.

There’s quite a different situation with Russia’s gas, though. Russia is expected to increase its gas production in 2025, targeting nearly 695.5 billion cubic meters, a notable rise from last year. To put that in perspective, the U.S. Department of Energy estimates that the United States will produce around 1.07 trillion cubic meters (or 37.8 trillion cubic feet) of dry natural gas in 2024.

Russia remains a significant player in the natural gas supply market in the Eastern Hemisphere. However, there’s a twist: consumers are now left in the dark about the planned volumes of LNG deliveries via the intermediary marine fleet and how these might be affected by weather conditions. This lack of transparency sets the stage for increased volatility and heightened anxiety, especially since gas is irreplaceable in many industrial sectors, such as chemical and fertilizer production.

What Awaits the Energy Market in 2025

The global energy map is being redrawn in real time. As supply chains reroute, alliances fracture, and climate commitments evolve, one truth holds: the age of cheap certainty is over. Investors who treat volatility as an anomaly will be left behind.

Increased oil price volatility. Geopolitical uncertainty will continue contributing significantly to oil and natural gas market price fluctuations.

Deepening changes in trade flows. Traditional energy trade routes remain disrupted, as Russia has increased its supply through alternative routes, while Europe continues to explore non-Russian sources of imports.

The ongoing transformation of energy doctrine in some regions. Energy security and climate change concerns are spurring further investment in renewable energy in Europe and other major economies, despite the downgrading of the overall agenda with the arrival of a new White House Administration.

Geopolitical competition for energy resources. Competition for stable and reliable energy supplies will continue to intensify among major consuming countries.

Potential for release of strategic reserves (SPRs). Governments of the world’s major economies have, in repeated episodes, strategically released — and are likely to continue doing so — specific amounts of their oil or gas reserves to mitigate price spikes caused by geopolitical turmoil and trade tariffs.