Wall Street is kicking off an earnings season against an exceptionally unusual economic backdrop. As financial institutions like JPMorgan Chase, BlackRock (BLK) and Wells Fargo (WFC) reported first-quarter results today (April 11), their CEOs used the opportunity to sound off on the chaotic market impacts of the Trump administration’s tariff policy.

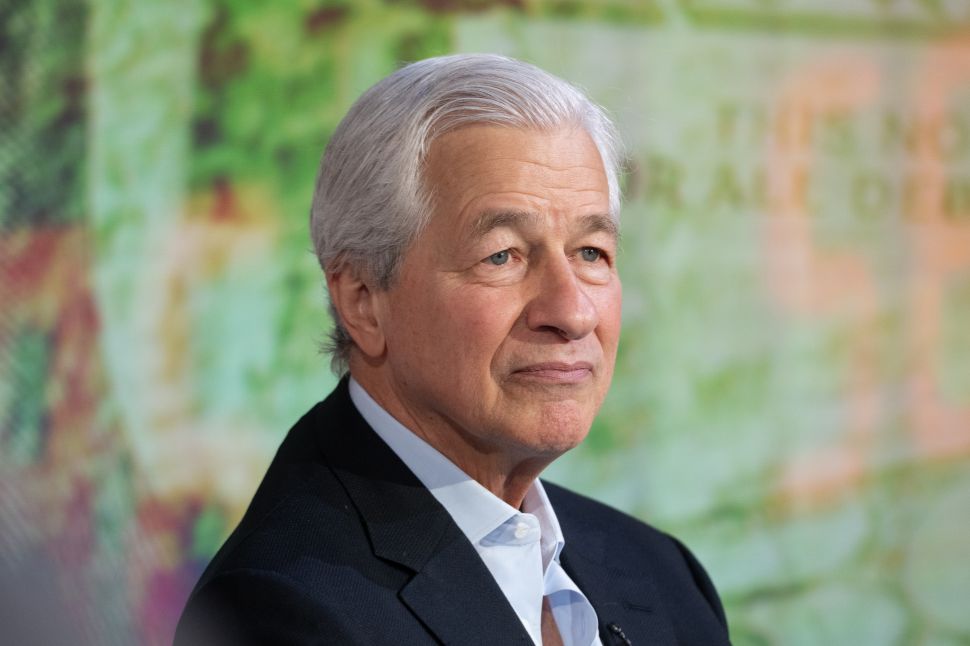

“The economy is facing considerable turbulence,” said JPMorgan’s Jamie Dimon in a statement accompanying the bank’s first-quarter earnings release that cited factors like tariffs and trade wars as “potential negatives.”

The banks say their clients are exercising a wait-and-see strategy as they navigate the uncertain economic environment caused by the tariffs. “I was traveling in Europe last week when the sweeping U.S. tariff announcements went beyond anything I could have imagined in my 49 years in finance,” BlackRock CEO Larry Fink told analysts today, adding that anxiety about the future of the economy is “dominating each and every client conversation.”

Market panic scaled down earlier this week after Trump announced a 90-day pause for much of the levies. While a 10 percent “baseline tariff” still remain in place. China was the only country not spared. On the contrary, the President has hiked up total tariffs on Chinese imports to 145 percent.

“The China issue is a major issue,” Dimon said today during JPMorgan’s earnings call. “It’s a significant change that we’ve never seen in our lives.” He added that he is more worried about national security implications than economic fallout related to the tariffs.

As the 10 percent universal tariffs stay in place and the standoff with China continues, the U.S. faces a 50/50 chance of a recession this year, Dimon said, citing JPMorgan economists’ latest forecast.

Fink is even warier about the odds. “I think we’re very close, if not in a recession now,” he told CNBC today after BlackRock reported first-quarter earnings.

Bank CEOs urge for the U.S. to strike trade agreements with tariffed nations as soon as possible. Despite noting that he supports the Trump administration’s “willingness to look at barriers to fair trade,” Charles Scharf, head of Wells Fargo, told analysts today that “timely resolution” would benefit businesses, consumers and markets alike.

“This isn’t Wall Street vs. Main Street,” said Fink, who pointed to the retirement and college savings accounts of ordinary Americans as vulnerable to stock hits.

While JPMorgan, BlackRock and Wells Fargo don’t import physical goods from China and other tariff-hit countries, they could still be caught in the crosshairs of the U.S.’s trade war with the rest of the world.

Dimon conceded that it’s a tricky time to be a U.S. company conducting business abroad. “I do think some clients or some countries will feel differently about American banks and we’ll just have to deal with that,” he said.

Fink noted that his firm plans to open more offices outside of the U.S. to continue operating “hyper-locally” across different regions. “We are Mexican in Mexico, Canadian in Canada, Dutch in the Netherlands, British in the U.K., Irish in Ireland, Japanese in Japan—this is not something new,” he said.